WHAT IS AN EMERGENCY?

Gas leaks, odor of gas, damaged lines, carbon monoxide symptoms and water main breaks are all considered emergencies.

If you smell gas, do not attempt to locate the leak. Instead, leave the house or building right away. Do not use any electrical switches, appliances, lights, telephones, or mobile devices, as an electrical charge could create a spark. When you are in a safe place, call M.U.D.'s emergency hotline at 402.554.7777 or 9-1-1.

If someone is showing symptoms of carbon monoxide poisoning, call 9-1-1 immediately. Symptoms are like the flu.

If you have a water-related emergency, call 402.554.7777. Our personnel are ready to assist you 24/7. When in doubt, call us immediately.

Learn More¿QUÉ ES UNA EMERGENCIA?

Las fugas de gas, el olor a gas, las tuberías de gas dañadas, los síntomas de monóxido de carbono y roturas en las tuberías principales de agua son consideradas emergencias.

Si huele a gas, NO trate de localizar la fuga/escape. Al contrario, abandone la casa o el edificio inmediatamente. No utilice los interruptores eléctricos, electrodomésticos, luces, teléfonos o equipos móviles, ya que una carga eléctrica podría provocar una chispa. Una vez que se encuentre en un lugar seguro, entonces llame a la línea directa de emergencia de M.U.D. al 402.554.7777 o al 9-1-1.

Si alguien tiene síntomas de envenenamiento causados por el monóxido de carbono, llame al 9-1-1 inmediatamente. Los síntomas son como los de la gripe/catarro.

Si tiene una emergencia relacionada con el agua, llame al 402.554.7777. Nuestro personal está listo para ayudarle, 24/7. Cuando dude o crea que hay una emergencia, llámenos de inmediato.

Aprende Más

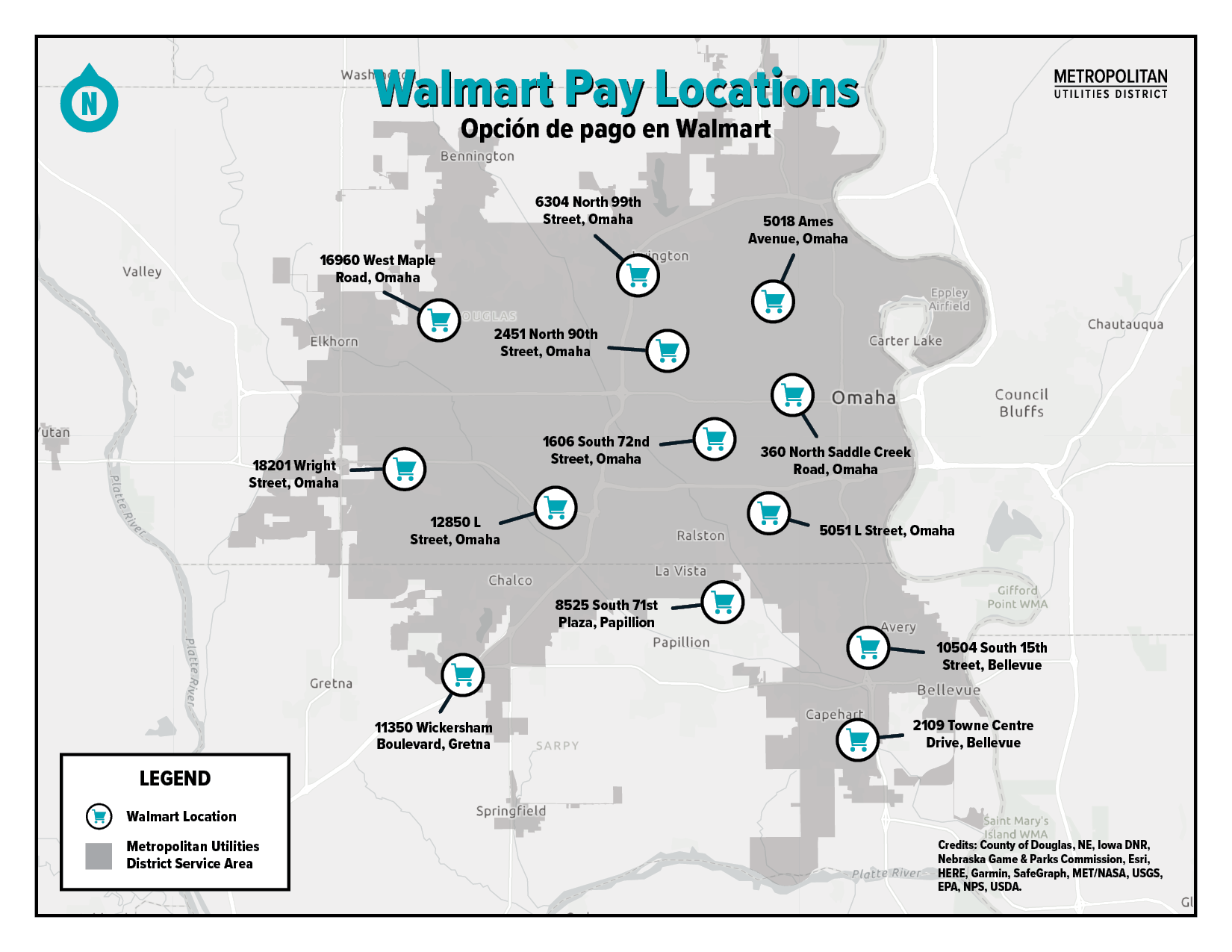

Introducing: Walmart Pay

You can now pay your M.U.D. bill at any Walmart in the United States.

See the map for convenient metro Omaha area locations.

Here’s how to use the service:

- Ask for Walmart Pay (not Check-Free) at any area Walmart location. You must request “Walmart Pay” for your payment to post immediately.

- Provide the phone number associated with your M.U.D. account.

- Confirm your M.U.D. account number.

- If you are a first-time Walmart Pay user or if your payment is over a certain amount, you may be required to show a government-issued I.D.

- Pay any amount you choose using cash or a debit card with PIN. Credit card and check payments are NOT available.

- There is no fee to use this service.

-

Online

Recurring or auto payment (eCheck, Visa, Mastercard, Discover, PayPal, Venmo and text-to-pay).

*For step-by-step instructions on how to sign up for recurring payments, click here.

*Para obtener instrucciones paso a paso sobre cómo registrarse para pagos recurrentes, haga clic aquí.

-

By Phone

Use the 24/7 automated menu at 402.554.6666 (eCheck, Visa, Mastercard, Discover).

If you have questions or to discuss payment arrangements, call 402.554.6666 (toll-free: 1.800.732.5864), 7:30 a.m.-5:15 p.m., Monday-Friday.

For information on payment assistance programs, visit Utility Assistance.

-

In-Person

Use Walmart Pay at any Walmart location in the U.S. See above map for more information.

Use the drop box at M.U.D. Operations Center Entrance, 3100 S. 61st Ave., Gate 1. (Check, cash or money order). Please note that this location is closed to walk-in customer services.

-

By Mail

Use the remittance stub provided with your bill and mail to PO Box 3600, Omaha, NE 68103.

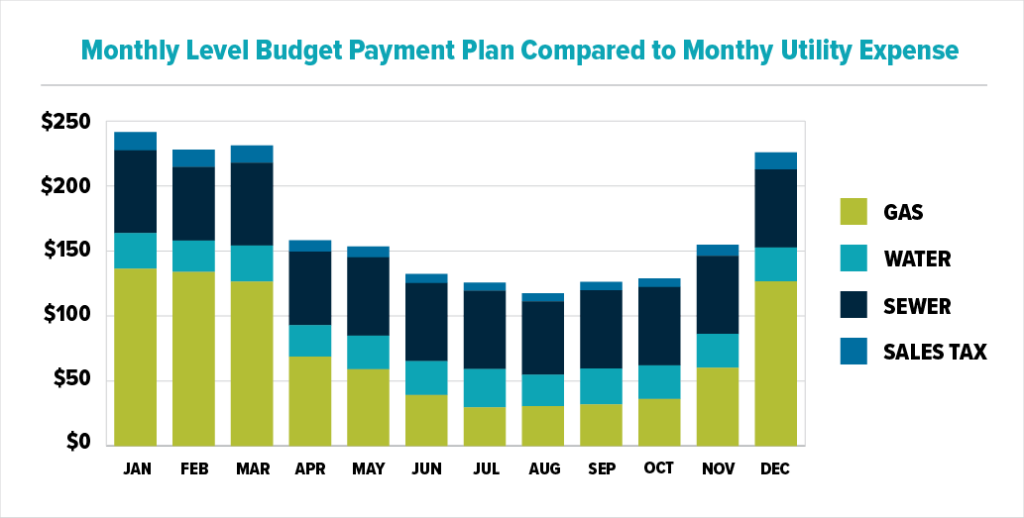

Budget Payment Plan

Though seasonal temperatures vary, your gas and/or water bill remains the same every month with the Budget Payment Plan. The budget payment is based on your average monthly costs from the last 12 months. This figure is adjusted for average temperatures to project normal use and any projected rate change. At the end of the budget year, a credit or debit balance is automatically factored into the next 12-month cycle.

How to Enroll

You may begin the Budget Payment Plan any month, provided you have an account balance of zero. You may cancel the plan any time.

If you have any questions or would like to sign up, please submit a request via Contact Us or call Customer Service at 402.554.6666.

Budget Plan Recalculation and Changes

We review the last 12 months of history, project out for weather (degree days and precipitation) and any known or projected rate increases for gas, water and sewer. We are a billing agent for several cities and take into account their sewer rates, including rate increases.

At the end of the budget year, a credit or debit balance is factored into the next 12-month cycle. Budget Plan balances are reviewed periodically throughout the year and you will be notified of changes.

Additional payments can be applied to your balance at any time. Please indicate any additional amount to be applied to the balance with the check box on your remittance stub or contact Customer Service.

Billing Prices for Customers

M.U.D. has put together detailed information about pricing for everything from appliance service work, to gas and water repairs.

Budget Payment Plan

-

How do I understand my Budget Payment Plan on my bill?

Budget Payment Plan is shown on the top right hand section of your bill.

TOTAL DUE: The Budget Payment Plan amount that was determined when you signed up. This amount is recalculated every year on your budget plan anniversary.

CURRENT BUDGET VARIANCE: Actual charges for the month minus the budget payment amount.

TOTAL BUDGET VARIANCE: Accumulated variance of all actual charges minus the budget payment amount.

– If this amount is a credit, or negative amount, it means that the budget payment amounts have exceeded the charges based on actual usage.

– If this amount is a positive balance, it means that the charges based on actual usage have exceeded the budget payment amounts.

– If your positive balance is more than three times your budget payment amount, please contact us to evaluate if your budget payment amount should be increased. Or consider paying extra towards your budget variance. If you are paying extra to be applied to your budget variance, please indicate this with your payment.

How is your Budget Payment Plan payment amount calculated?

Your monthly budget payment is the total of the last 12 monthly actual bills, adjusted for normal weather and projected rate changes, plus or minus your total budget variance balance divided by 12.

Example:

- Current Budget Plan payment amount = $125

- At the end of the budget billing year customer budget payments = $1,500 ($125 payment each month for 12 months)

- At the end of the budget bill year customer’s actual charges = $1,700

- Total Budget Variance = $200 ($1,700 actual charges minus $1,500 payments)

- New Budget Plan payment amount = $158 ($1,700 last 12 months actual bills + $200 total variance divided by 12 months)

Budget plan changes:

We review the last 12 months of history, project out for weather (degree days and precipitation) and also any known or projected rate increases for gas, water and sewer. We are a billing agent for several different cities and take into account their sewer rates for the budget plan.

-

How is my budgeted amount calculated?

Your initial monthly budget payment will be the total of the previous 12 monthly bills at your current residence plus your current account balance divided by 12. On your Budget Payment Plan anniversary date, your payment will be entirely recalculated by adding the total of the previous 12 months’ actual bills at your current residence to your current account balance and dividing by 12.

Budget plan changes:

We review the last 12 months of history, project out for weather (degree days and precipitation) and also any known or projected rate increases for gas, water and sewer. We are a billing agent for several different cities and take into account their sewer rates for the budget plan.

-

Why did my budget payment increase?

We review the last 12 months of history, project out for weather (degree days and precipitation) and also any known or projected rate increases for gas, water and sewer. We are a billing agent for several different cities and take into account their sewer rates for the budget plan.

-

Why do you estimate bills?

We estimate bills if we are unable to obtain an actual reading.